Be recognized as the elite professional who goes beyond the norm, committing to an unparalleled level of service within the transportation and motor carrier sector. The TRS mark is not just a symbol; it’s a testament to your dedication to excellence and specialized knowledge. Propel your career forward, distinguish yourself in the industry, and join the ranks of those who set the standard for incomparable service. Become a Transportation Risk Specialist and redefine your impact in the world of transportation insurance today!

TRS Curriculum

Path A

OR Path B

PLUS

FAQs

Upcoming TRS Educational Events

AC 2024: TCS/TRS Core Class: Sophisticated Coverage Options

2024 MCIEF Conference | TCS/TRS Core Class [...]

TCS/TRS Core Class: Trucking from an Insurance Perspective

TCS/TRS Core Class Trucking from an Insurance [...]

TRS Core Class: Introduction to Underwriting

TRS Core Class: Introduction to Underwriting [...]

TCS/TRS Core Class: Introduction to Coverage

TCS/TRS Core Class Introduction to Coverage [...]

TRS Core Class: Underwriting Analysis

TRS Core Class: Underwriting Analysis [...]

TRS Core Class: Complicated Risk Issues

TRS Core Class: Complicated Risk Issues [...]

TCS/TRS Core Class: Coverage Analysis

TCS/TRS Core Class: Coverage Analysis [...]

TCS/TRS Core Class: Sophisticated Coverage Options

TCS/TRS Core Class: Sophisticated Coverage Options [...]

TCS/TRS Core Class: Fraud and Insurance Integrity

TCS/TRS Core Class: Fraud and Insurance Integrity [...]

TRS Summit 2024: TCS/TRS Core Class: Trucking from an Insurance Perspective

TRS Summit 2024 | TCS/TRS Core Class [...]

TRS Summit 2024: TRS Core Class: Introduction to Underwriting

TRS Summit 2024 | TRS Core Class: [...]

TRS Summit 2024: TCS/TRS Core Class: Introduction to Coverage

TRS Summit 2024 | TCS/TRS Core Class [...]

TRS Summit 2024: TRS Core Class: Underwriting Analysis

TRS Summit 2024 | TRS Core Class [...]

TRS Summit 2024: TCS/TRS Core Class: Coverage Analysis

TRS Summit 2024 | TCS/TRS Core Class: [...]

TRS Summit 2024: TCS/TRS Core Class: Fraud and Insurance Integrity

TRS Summit 2024 | TCS/TRS Core Class [...]

TCS/TRS Core Class: Trucking from an Insurance Perspective

TCS/TRS Core Class Trucking from an [...]

TRS Core Class: Introduction to Underwriting

TRS Core Class: Introduction to Underwriting [...]

TCS/TRS Core Class: Introduction to Coverage

TCS/TRS Core Class Introduction to Coverage [...]

TCS/TRS Core Class: Fraud and Insurance Integrity

TCS/TRS Core Class: Fraud and Insurance Integrity [...]

TRS Core Class: Underwriting Analysis

TRS Core Class: Underwriting Analysis [...]

TRS Core Class: Complicated Risk Issues

TRS Core Class: Complicated Risk Issues [...]

TCS/TRS Core Class: Coverage Analysis

TCS/TRS Core Class: Coverage Analysis [...]

TCS/TRS Core Class: Sophisticated Coverage Options

TCS/TRS Core Class: Sophisticated Coverage Options [...]

TCS/TRS Core Class: Trucking from an Insurance Perspective

TCS/TRS Core Class Trucking from an [...]

TRS Core Class: Introduction to Underwriting

TRS Core Class: Introduction to Underwriting [...]

TCS/TRS Core Class: Introduction to Coverage

TCS/TRS Core Class Introduction to Coverage [...]

TCS/TRS Core Class: Fraud and Insurance Integrity

TCS/TRS Core Class: Fraud and Insurance Integrity [...]

TRS Core Class: Underwriting Analysis

TRS Core Class: Underwriting Analysis [...]

TRS Core Class: Complicated Risk Issues

TRS Core Class: Complicated Risk Issues [...]

TCS/TRS Core Class: Coverage Analysis

TCS/TRS Core Class: Coverage Analysis [...]

TCS/TRS Core Class: Sophisticated Coverage Options

TCS/TRS Core Class: Sophisticated Coverage Options [...]

TRS Educational Requirements

PATH TO TRS

In order to become a Transportation Risk Specialist, you must complete all of the following educational requirements:

1. Your work entity must be an active MCIEF Member

2. There are two class paths (A or B) to TRS and you must choose one and complete the 40 hour TRS core curriculum

Each year a TRS Graduation is held at our Annual Conference. While attendance is not required, this is our opportunity to honor and recognize your TRS designation!

PATH TO MAINTAIN TRS | Starting March 1, 2024

To maintain your TRS Designation, you must meet the following requirements:

1. Your work entity must be an active MCIEF Member

2. Attend 5 Truck Stop Podcasts within a two-year period

3. Attend at least one of the following events every two years:

a. Annual Conference

b. Western Conference

c. TRS Summit

4. Complete a minimum of 8 hours TRS Intermediate or Advanced level curriculum every two years

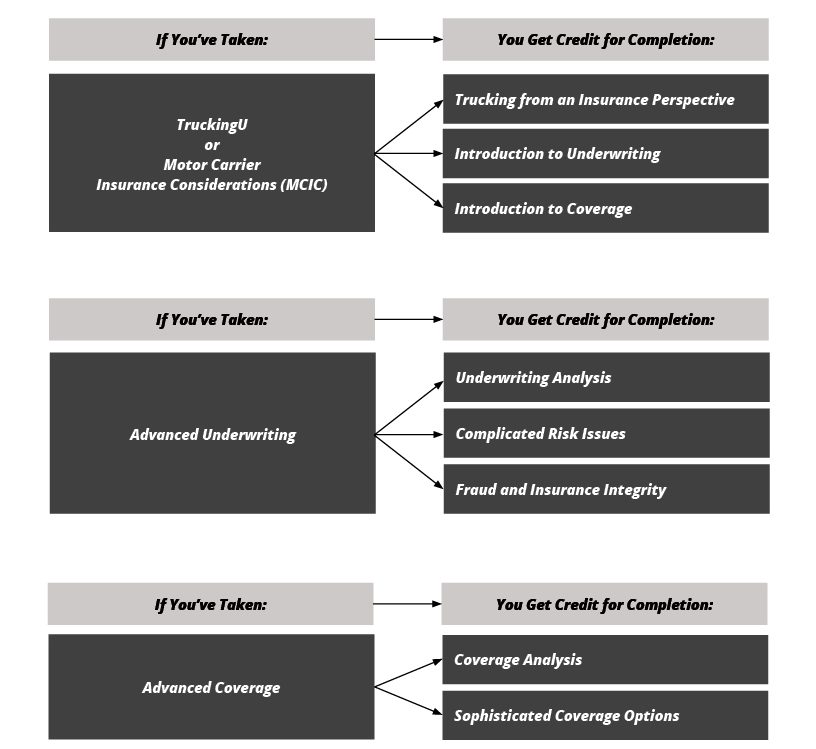

Legacy vs. New TRS Path

Take a look at the chart provided below, illustrating the comparison between the Legacy and New Paths. This visual guide outlines the credits you’ll receive for completing the legacy classes and identifies the new classes required to attain your TRS designation.

Questions? Email [email protected] to find out how you can complete your TRS classes now.